- Call: +234807-614-8639

- Email: info@spahr.international

The Certificate in Financial Literacy and Public Sector Budgeting is designed to equip participants with the knowledge and skills to make informed financial decisions while also gaining an understanding of how public resources are planned, allocated, and managed.

The financial literacy component of the course covers budgeting basics, saving and investment principles, debt management, and financial planning for personal and professional growth. Participants will learn how to interpret financial information, build healthy financial habits, and develop strategies for long-term financial stability.

The public sector budgeting component introduces the budgeting process in government institutions, including budget formulation, approval, execution, and evaluation. Learners will explore how public funds are allocated, the role of transparency and accountability, and the impact of budgets on policy and development outcomes.

Through practical exercises, case studies, and simulations, participants will strengthen both their personal financial skills and their ability to understand and engage with public sector financial systems.

By the end of the program, learners will be able to manage personal finances more effectively and develop an appreciation of how budgeting shapes governance, development, and service delivery.

0 Reviews

Master the art of critical thinking, effective problem-solving, and smart decision-making to excel in today’s dynamic workplace.

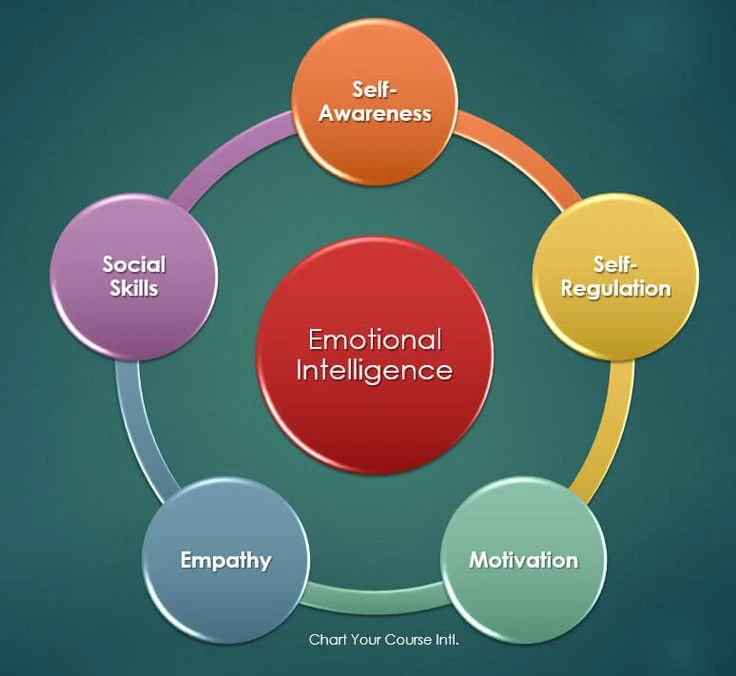

This course explores the principles and practical applications of Emotional Intelligence (EQ), focusing on self-awareness, self-regulation, empathy, motivation, and social skills.

The Certificate in Public Administration & Human Resource Management equips learners with essential knowledge and practical skills in governance, leadership, and people management. Ideal for students, professionals, and emerging leaders seeking career advancement in administration and HR.